Brett Boadway—Chief Operating Officer, IBAO

It’s that time of year again when insurer financial statements are released and collected by MSA Research to assess market share by distribution type. The commissioned report is based on insurers’ direct written premiums in Ontario, filtered by insurer distribution strategies. Results are treated as estimates, as some insurers file their financial results as a single company despite distributing direct and through brokers (CAA Insurance is an example—this report features them as direct only). Some insurers with multiple distribution strategies file their financial results separately (Intact Insurance/Belair Direct). And not all mutual insurers share their financial results with MSA, and therefore aren’t included in this report.

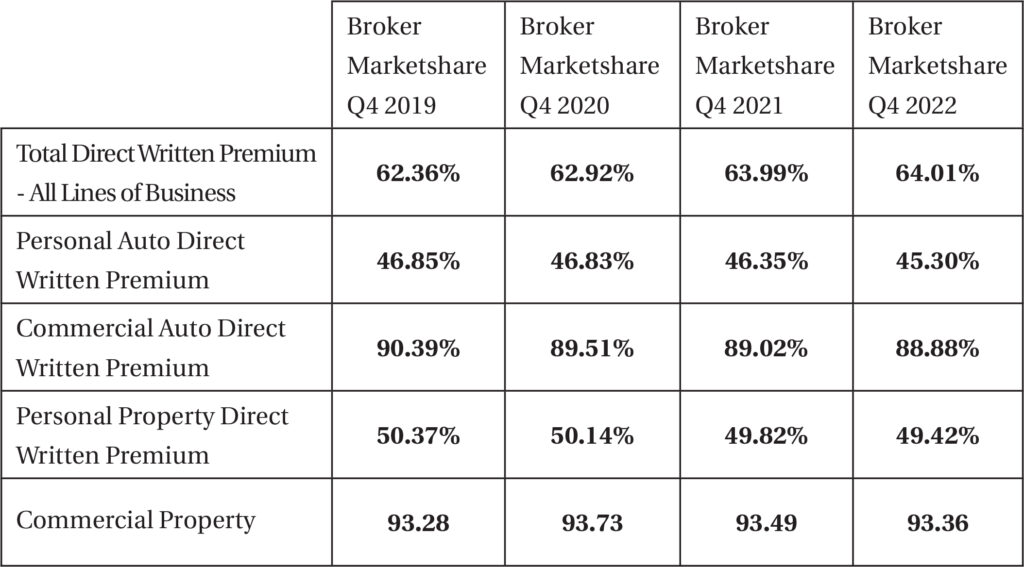

Broker Distribution Market Share in Ontario as Expected

When you look at specific lines of business (Personal Property, Personal Auto, Commercial Auto, Commercial Property), 2022 numbers are slightly lower than 2021. But total direct written premium lines indicate that broker market share increased slightly last year overall. This suggests that some or all lines of business that aren’t included in MSA’s report (Commercial Liability, Commercial Specialty like Surety, Marine, etc.) were higher in 2022 versus 2021 to balance the average. This makes overall broker market share based on direct written premium in 2022 higher than the year prior.

Ontario Brokers Continue to Dominate Commercial Lines Distribution, But Pressure is on as Direct Writers Announce Plans to Target Small Businesses

Overall, approximately 95% of all commercial insurance products continue to be distributed through brokers, a line that brokers have continued to hold steady year over year. However, in Q1 this year, TD Insurance launched TD Insurance for Business, offering commercial property, commercial auto for business vehicles and commercial general liability coverage to Canadian small businesses. Their focus is set on Ontario according to their press release. It’s reasonable to expect that this will move the needle away from broker distribution as they market their products to this new audience. But brokers should feel confident in their ability to remain extraordinarily competitive in this space with a value proposition closely aligned to the needs of most business owners.