Chris Weston—Regional VP Business Development and Broker Financial Solutions

There is no question most of us wish we could flip a switch to return to a normal world as quickly as it was turned off in the spring of 2020. While some things have begun to return to the way they were before the pandemic, we still have a long way to go. While the industry made its 2022 plans at the end of 2021 with some normal world assumptions, many of those plans are not coming to fruition. Unica has seen good growth over this time, but we have also been very busy focusing on repositioning the organization for much more aggressive growth posture moving forward. It has been a challenging pivot over the last two and half years as these strategic changes have necessitated a series of key leadership changes and appointments. On top of that, Unica has been very busy with integration projects following the merger its parent company La Capitale with SSQ, forming Beneva .

Jennifer Ronca, Unica’s COO, continues to lead the only Beneva P&C operation outside of Quebec. Beneva represents over $5B in GWP and is the largest mutual insurer in Canada. Beneva’s size provides Unica with the needed scale and resources to allow for its continuing evolution. At present, Unica’s focus will remain on Ontario, leaving open the possibility of exploring new growth opportunities in other provinces in the future.

The mandate of Beneva and Unica is to double in size. To achieve this Unica must increase the number of opportunities it explores and there are many levers to make this happen. One of these levers is additional broker appointments and establishing True Partner relationships. Chris Weston, Unica’s Regional VP of Business Development and Broker Financial Solutions and his team are working diligently to pursue these opportunities and explore closer partnerships with some of our very supportive brokers. These partnerships are being built with brokers that value Unica as their go-to market for their clients—clients whose professional and personal lifestyles align with Unica’s appetite. We are already on track to appoint a record number of new brokers in 2022.

On the Commercial side and under the new leadership of Monica Celisano, Regional VP of Commercial Insurance, we remain committed to our target segments. We also remain disciplined in our contribution to the 2022 average 9% reinsurance premium increases, minimizing our contribution to the potential of stagflation, staying within our capacity limits, while simultaneously allowing our brokers to compete.

With the appointment of Tanya Eryam as Regional VP of Personal Insurance in February 2022, the Personal Insurance strategy focusing on Brokers’ VIP clientele has widened. The VIP market offers a large customer base that is directly aligned with our new and enhanced LIVEasy product, a product that focuses primarily on client lifestyle over traditional asset-based products. This target customer product, coupled with sophisticated pricing and claims satisfaction, makes Unica the market of choice for our Brokers VIP clientele.

Doug Cyr, appointed Regional VP of Claims in June 2022, is focused on continuing to deliver its best-in-class claims experience for Unica policyholders. Claims satisfaction continues to average an incredible 98% with the in-house and off-site adjuster teams, and Unica remains the best in the industry in both everyday claims settlements and catastrophic events. Ever-changing climate conditions and complexity of risk and lifestyle will continue to place pressure on our claims service but Unica will continue to stay ahead of broker and insured expectations. Ultimately, this is what our Brokers and their clientele demand and measure us by.

As Unica continues its transformation in 2022 and repositions itself for aggressive future growth, our core strategy remains the same: sustainable growth to broaden our foothold in a niche part of the market while continuing to deliver a best-in-class claims experience. Our broker wants certainty that their client is placed with an insurer that can deliver on its promise to protect them, provide expertise and tangible solutions when they need it most.

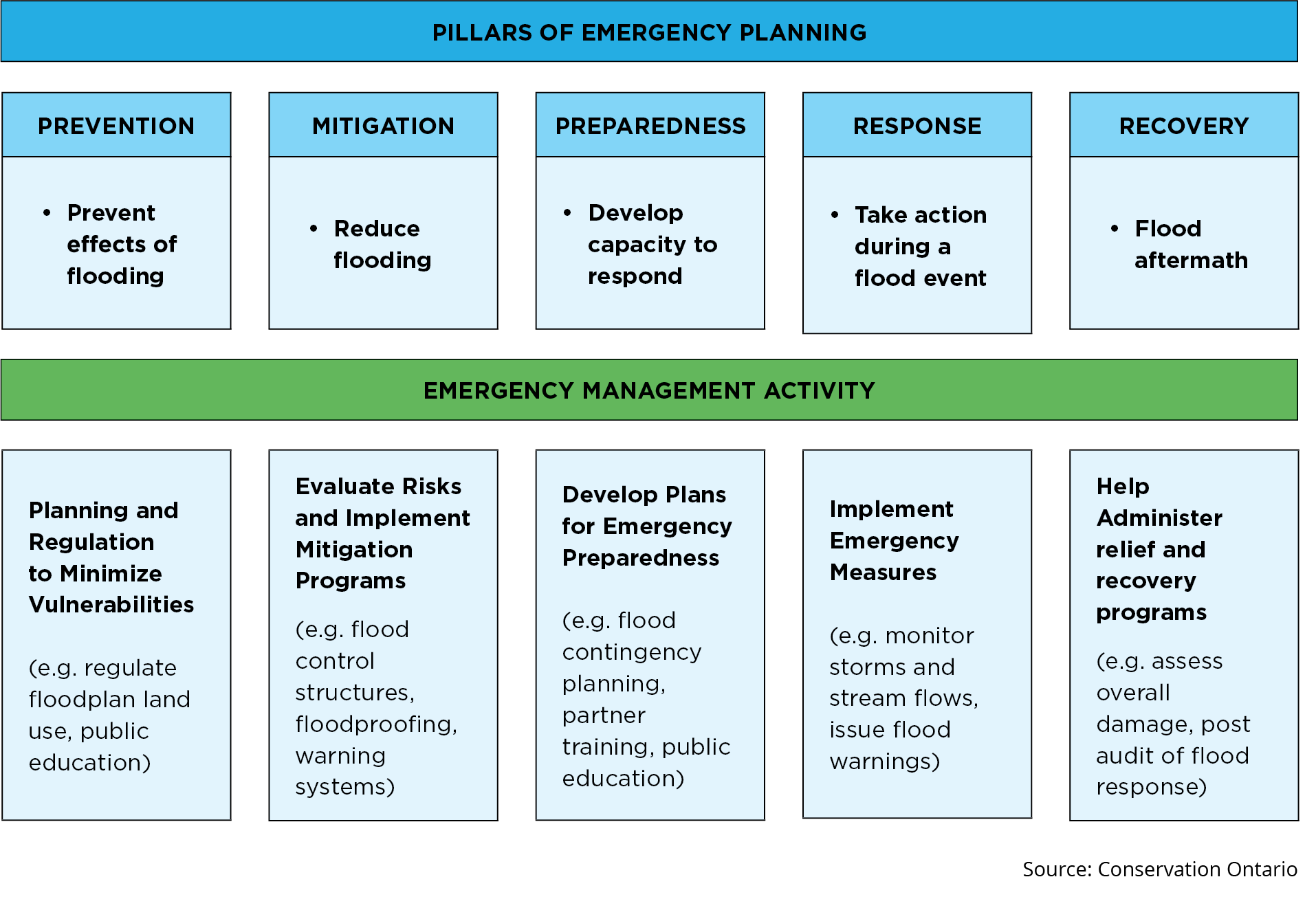

Conservation authorities bring added protection and benefits with their foundational watershed management activities which include: watershed-scale monitoring, data collection management and modelling, watershed-scale studies, plans, assessments and strategies, and watershed-wide actions including working with individual landowners and partners on stewardship initiatives that involves natural infrastructure like tree planting, wetland restoration, communications, and outreach and education activities.

Working Together with Brokers

Conservation Ontario and our conservation authority members encourage IBAO members to take the course so they can increase their understanding of flooding and erosion in Ontario and how it’s managed by conservation authorities and our municipal, provincial and federal partners. As a result, brokers will be more equipped to help their clients to access resources and information about how they can keep themselves and their families safe and reduce their risk of costly property damage. This includes contacting local conservation authorities to find out what and where the specific local hazards and risks are in your watershed.

Everyone has a role to play, including the insurance industry. We look forward to building good relationships between the insurance industry and Ontario conservation authorities and seeing the positive impact we can have together on our shared environment.