Brett Boadway—Chief Operating Officer, IBAO

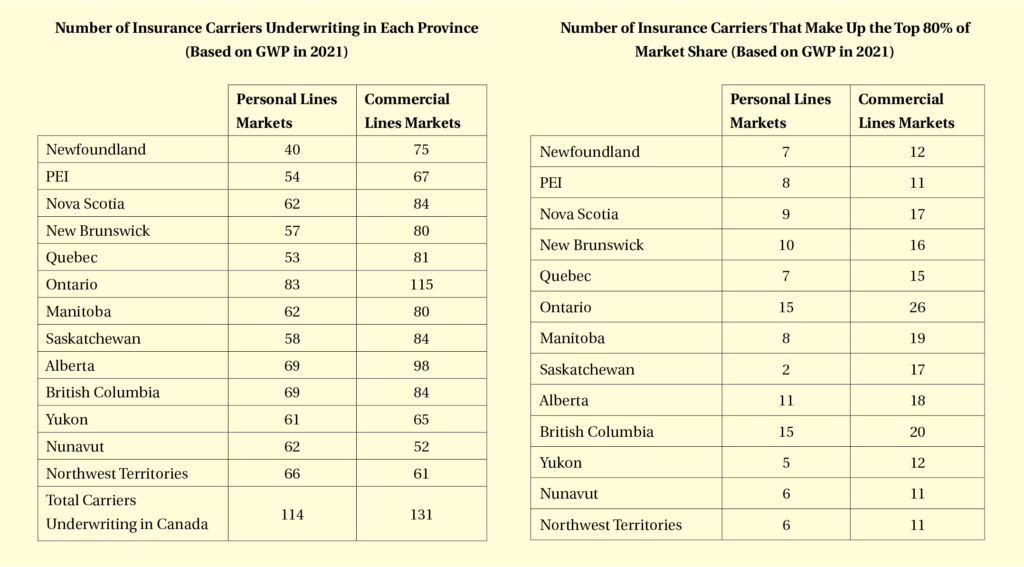

While it’s true that the Canadian P&C insurance industry is growing more concentrated, it’s important to apply the broader perspective. Despite consolidation, the industry remains abundantly healthy, diverse and competitive. To visualize this fact, we drew data from Market-Security Analysis & Research Inc. (MSA Research)—a Canadian-owned, independent and impartial analytical research firm focused on the Canadian insurance industry—and assessed the market share of each insurance company transacting business in each province.

This data reflects 2021 financial information relating to 95% of Canadian insurers. The charts present market share based on the insurers’ direct written premiums, per province. Results presented in this article should be treated as estimates given that only 95% of insurers report their financials to MSA Research and because financial reporting processes during insurer consolidation efforts take time to transition. For example, in the data shown below, Intact Insurance and RSA Canada are treated as two distinct insurers.

As noted, not every province is the same and each market structure presents differently depending on the province. Saskatchewan, for example, is dominated by the Saskatchewan Auto Fund and SGI Canada, collectively making up over 80% of the personal lines market. Compare this against Ontario, which has 80% of the personal lines market being serviced by 15 insurers. Clearly, the broker distribution strategies for competing in Saskatchewan would be different than those strategizing in Ontario.

Overall, the Canadian insurance market structure is healthy and competitive. It’s positive that a high level of competition generally exists between insurers across Canada. As basic economic principles suggest, competition between companies translates into a greater quantity of products and services, better quality of goods and lower prices. In the end, this is what consumers are looking for, the best quality at the best possible price.