For nearly a year, small businesses have faced unprecedented challenges—many being shut down or working in a reduced capacity. But despite these difficulties, a majority have persevered. With vaccination already underway, there’s hope of some kind of normalcy in the near future, and for those that have survived this long, it’s a matter of holding out a little longer.

ONE BUSINESS’ STORY

Georgian Bay Software sits between Parry Sound’s public library and the town offices downtown where local council meets. It’s cottage country about 200 kilometers north of Toronto. Since 2004 the business has been owned by a married couple, Angel and Daryl McMurray. The store’s remained open throughout the pandemic—software and hardware are deemed essential services.

The business employs five people total. So far no one’s been laid off during the pandemic.

“March, April and May were very quiet,” Angel recalls. She describes the beginning of the pandemic as “a lot of uncertainty.” The store’s sales slumped, and government assistance programs weren’t fully rolled out. In April alone, the business faced a 60 percent drop in sales. Then they were able to obtain a Canada Emergency Business Account (CEBA) loan of $40,000 and took advantage of temporary federal government wage subsidy programs.

“The fact that the store offers both sales and repairs has kept our doors open,” Angel explains. Before the pandemic, repairs provided most of their income. But many customers are holding off on repairs. “If it’s not an emergency, they won’t get the repair done.”

Now, it’s sales that bring in most of their income, with individuals and companies needing laptops and printers to be able to work from home. Since June, business has held steady.

“We don’t manufacture hand sanitizer, but we’re doing okay,” jokes Angel. “If we were just computer retail or just repairs, it would have been tough. Luckily we have both.” She says last month their sales were rising to pre-pandemic levels as consumer confidence started to come back..

SURVIVAL GUIDE

Angel’s advice for small business owners is to be flexible. “Be open to adapting. There’s always a support structure to make it happen.” Businesses can get advice from associations and chambers of commerce. They can set up home offices.

Companies like Shopify that set up e-commerce platforms for online stores are now offering different packages and additional support. “Everyone is trying to adapt and help each other out.”

She observed how a local Parry Sound restaurant now offers pre-selected meals for take-out that include dessert, giving customers an easy way of ordering. “It’s not exactly catering but it’s close,” she notes. This change in operation means decision-making is easier for customers, and possibly more profitable for the restaurant. Some restaurants and delis have started offering free delivery to customers in Parry Sound. People have new needs, and those needs are being met in new ways.

RECOVERY

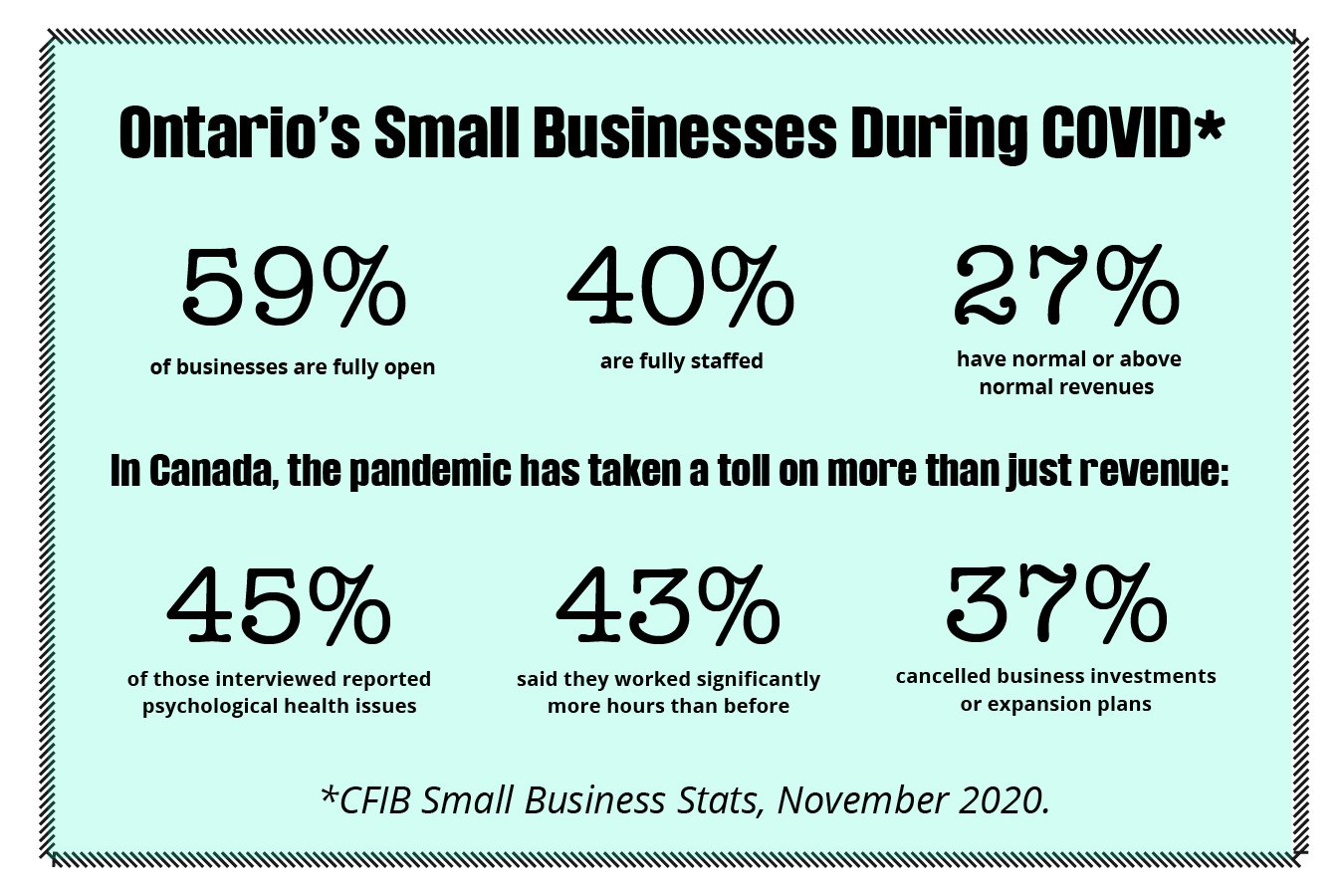

According to the Canadian Federation of Independent Business (CFIB), at the current pace of recovery all sectors in Canada will take an average of a year and a half to recover. Transportation and social service sectors like dentists and chiropractors will take nine months. Retail and personal services like dry cleaning and mechanics will be closer to the average. Restaurants and hotels may take as long as eight years to fully recover.

Though this has clearly hit some businesses harder than others, many have found a way to make it work. With the Ontario Small Business Support Grant and the expansion of CEBA in December, more will have the opportunity to pull through. In addition to this crucial government assistance, some businesses, like Angel and Daryl’s, are now in a position to look for ways of helping others.